The Data to Make Things Interesting

How bringing fresh data into the conversation helps brands sidestep promo fatigue

You are sitting at a bar. Someone you’re vaguely familiar with pops up, yells your name, asks to sit with you, says something you don’t quite get the point, and leaves. It happens again in the street. And in the market. And in the office. And at home. And it’s not just one person doing it, but fifty. And… You get the picture.

The Way We Use Data Risks Making Healthcare Comms Too Pushy

If you chuckled – and I hope you have – you know what I’m getting at. When we talk about data in our industry, we often talk about the bits fueling omnichannel orchestration: the data points that inform identity resolution, segmentation, asset delivery, channel preferences, content consumption, conversion, attribution, and so on. This is the data that allows us to follow our customers in the (admittedly) cheeky portrayal of the previous paragraph. This dynamic, along with increasing workload demands, contributes to making HCPs overwhelmed on every front(Ref.1). They have too much work, too much content, and too much pharma comms to deal with.

It is not that using data like this doesn’t work. It does. This is valuable data and can be the foundation of successful omnichannel programs. However, multiple companies running different programs and trying to reach customers across all touchpoints increase the cognitive load on the people we’re trying to help with important information.

The question, then, is how can we make this better? How can we use data to help our information get to the customers (and patients) who would benefit from it the most?

Going from Pull to Push with Untapped Data Sources

The answer lies in the data capable of fueling the omnichannel side that is less about operation and more about content. Ultimately, omnichannel is about a story unfolding across different touchpoints in different formats at different times. Much of our data use has been about the push: orchestrating the where, what, and when. The flip side of this is the story. The story is about the why. Why this information? Why am I interested in it now? This is where behavior is initiated by a motivation triggered by an immediate need. This is about the pull.

Data to inform a pull strategy is there, but it is not on the usual places like ad and experience platforms. This data comes from unstructured data sources, like qualitative research, cultural listening, and published content (e.g. papers). They require a different set of tools and techniques, but they offer a window into the hottest and most pressing topics and knowledge demands in research and clinical settings. By getting it right, brands can be prepared for when HCPs go looking. And look they do! The same surveys and reports that find them overwhelmed point to a consistent habit of actively seeking out information(Ref.2) as 33% of HCPs seek out medical information daily and 50% do so at least once a week (Ref.3).

Example: Using Language Data to Pull People In

Tracking how researchers and HCPs talk about conditions and therapies in different disease spaces is a prime example of this approach. The language used by HCPs can be used to expand SEM strategy, boosting keyword inventory to make the most of current behaviors and informing content creation to develop future ones.

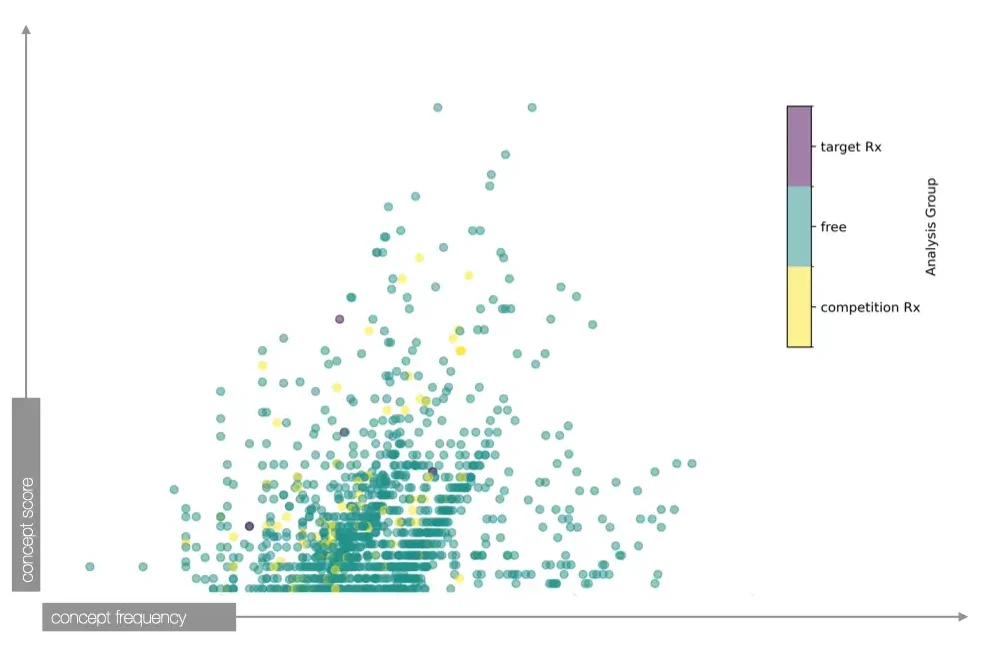

Fig 1. Illustrative example based on non-representative sample of medical resources data. The score captures the phrase’s importance in the corpus. Concepts linked to competitor Rx in yellow, concepts linked to the Target Rx in purple and Free concepts in green. Depending on the content strategy, a brand could decided to ‘conquer’ the green concepts or ‘invade’ the yellow ones.

Disease and therapy language maps also offer insights for pre-launch or at-launch brands in their efforts to carve a voice in categories shaped by competitors.

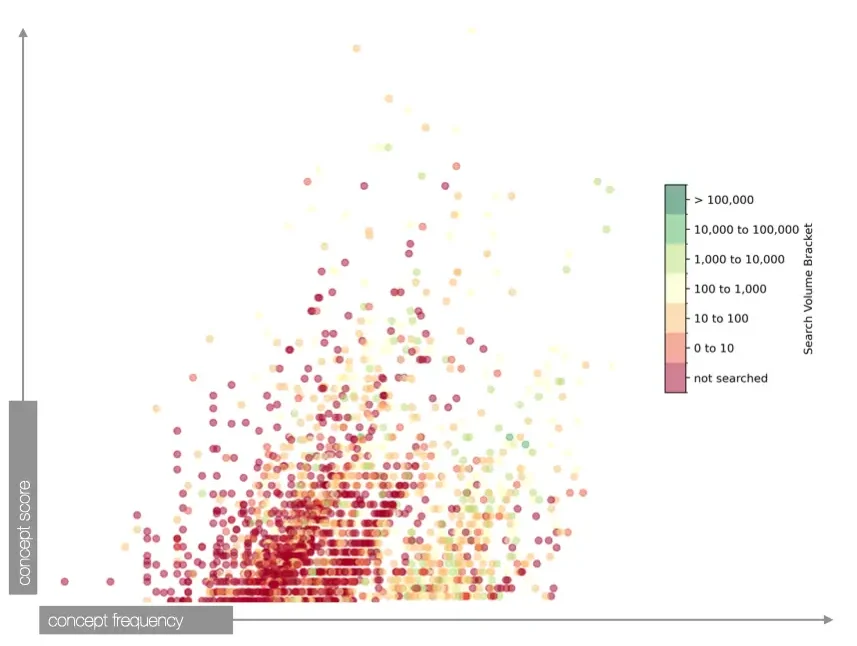

Fig 2. Illustrative example based on non-representative sample of medical resources data. The score captures the phrase’s importance in the corpus. Analysis of search volumes show which high relevance concepts are mainstream behaviors, niche behaviors or future behavior opportunities, informing SEM strategy in organic and paid.

Additionally, understanding specific linguistic landscapes can be particularly important when key concepts are shared by different diseases and therapies.

In this case, NLP (Natural Language Processing) procedures power data ingestion and then emerging concepts in each disease space are identified using a set of algorithms fine-tuned to the task. It takes into account usage, context, and distinctiveness while ensuring stability by being neither too general nor too specific. In practice, the process resulted in a keyword inventory up to 2.4x larger and nearly 50x more potential searches.

Clear Opportunities for Healthcare Communications

There is a clear opportunity to use data in different ways in healthcare communications and make it more relevant to customers. By using HCPs’ immediate interest as a starting point, for example, we can become the interesting people in the corner booth waiting to be approached by them. And because we used data to get our story right, we are ready to have a meaningful conversation when they do.

This article was written by Paulo Coelho Mendes. Paulo builds solutions to unlock the power of ‘hard’ and ‘soft’ data leveraging a mixed background in Sciences and Humanities. He has been doing it as Head of Data Science for SOLVE(D) Europe – an IPG Health Company since 2022 and as the founder of Serendipity Lab Insight Technologies for far longer.

References

-

The Digitally Savvy HCP, Indegene, 2021; For Physicians and Pharma, Hybrid Engagement Is the New Normal, BCG, 2023; PharmaPhorum Deep-Dive Magazine - M3 HCP Survey

-

Driving HCP Engagement, Wiley, 2023; Physician Learning Report, Doximity, 2023

-

Wiley, Driving Engagement for Healthcare Professionals, 2020; Driving HCP Engagement, Wiley, 2023; Physician Learning Report, Doximity, 2023

-

The fact that available Gen AI applications did not arrive at the same concepts and that training specialized ones is less cost-effective (and not likely to be more accurate) is also noteworthy