Beyond Healthcare Consumers: Pharma DTC TV and the Halo Effect to HCPs

Pharma brands spend billions on TV advertising to reach patients - but how much of that investment actually reaches healthcare professionals?

Pharmaceutical companies are investing billions of dollars in TV advertising. While these ads primarily target healthcare consumers, some marketers will mention to clients that they will also reach healthcare professionals (HCPs). But how many, exactly?

This is a critical question for marketers because the halo effect of direct-to-consumer (DTC) TV advertising on physicians, physician assistants (PAs), and nurse practitioners (NPs) can create media budget efficiencies by driving treatment awareness to each key audience. It also offers an opportunity to bridge the gap between traditionally siloed DTC and HCP marketing teams and strategies.

HCPs may be consumers like everyone else, but they are unique. Their work often dominates their day; on average, physicians see 17 patients in a workday, with each visit lasting about 25 minutes. More than half (53%) of physicians say they are reading general medical content during their leisure time, and that number rises to 69% for PAs and NPs.

Additionally, one in four physicians report being available to patients 24/7 for any need. This demanding schedule makes media consumption during their “blue-jean moments” more concentrated and on their schedule, especially when it comes to TV viewing.

So, how do HCPs consume TV? Where does their behavior overlap with healthcare consumers, and where does it differ? Insights drawn from M3 MI’s HCPs as Consumers studies, the MARS Consumer Health study, and our recent webinar Connecting with Physicians Beyond the Workplace highlight the following key findings:

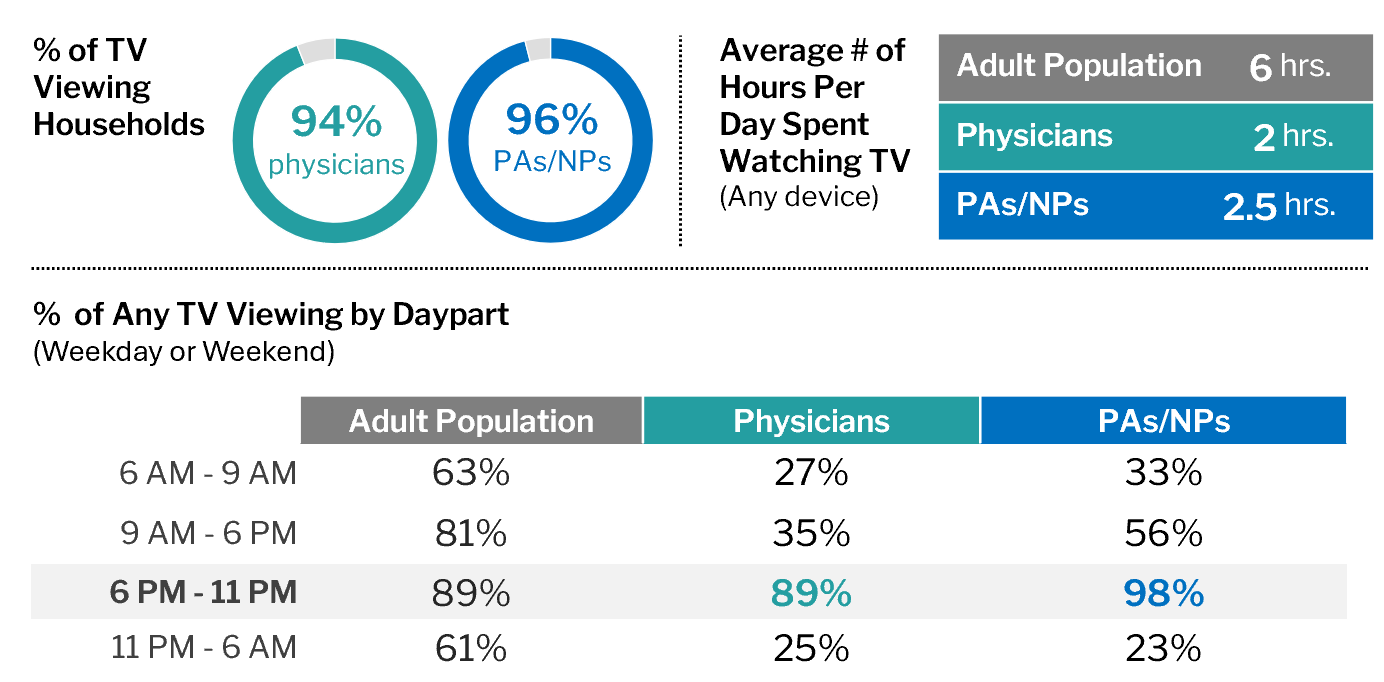

Concentrated TV Viewing

Nearly all HCP households watch TV, but they average about four hours less viewing time per day compared to the adult population. HCPs viewing is concentrated in prime-time and late-night dayparts, typically after work, whereas the broader adult population tends to watch more consistently throughout the day.

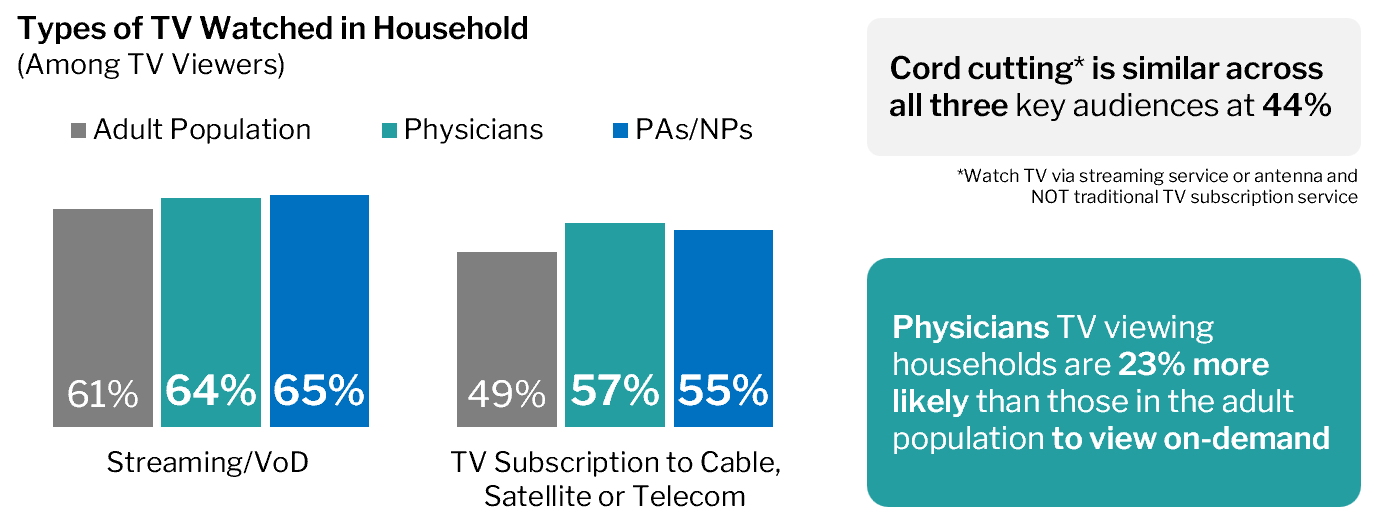

Streaming Leads, Cable Persists, On Their Schedule

Nearly two-thirds of HCPs stream TV or use video-on-demand, yet they remain 14% more likely than the adult population to keep a traditional cable, satellite, or telecom subscription. Cord-cutting rates are similar between HCPs and the broader population, but physicians stand out for their preference for on-demand viewing over live TV.

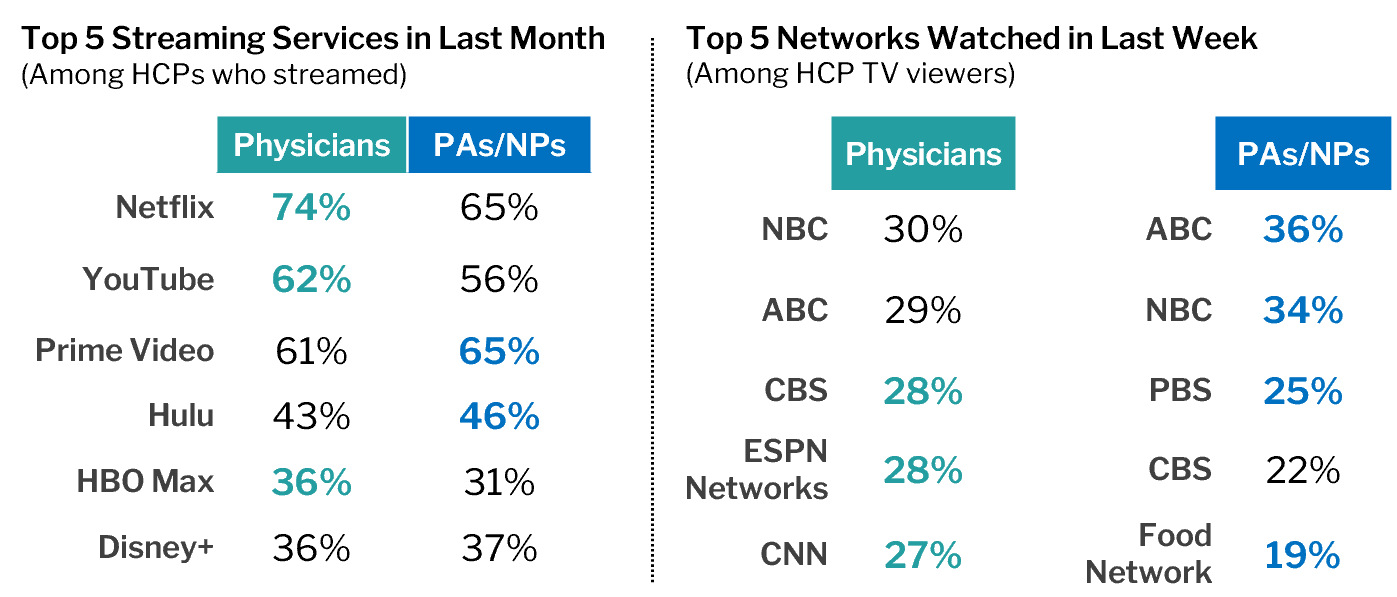

HCPs Viewing Differs by Streaming Services and Networks

HCPs tend to favor subscription-based streaming services over free options such as Pluto or Tubi. Among them, physicians are more likely to watch Netflix, YouTube, and HBO Max, while PAs and NPs lean toward Amazon Prime Video and Hulu. When it comes to TV networks, both groups tune-in to broadcast networks like NBC, ABC, and CBS. However, viewing preferences diverge slightly as physicians prioritize sports and news in their top choices, whereas PAs and NPs gravitate toward educational and food-related networks.

For healthcare marketers, these insights show the importance of avoiding media planning in traditional DTC and HCP silos. Planning together with M3 MI’s data allows teams to bridge gaps and showcase to their senior leadership efficiencies in broad awareness channels. While DTC TV advertising can create a halo effect among HCPs, their viewing habits differ slightly from the adult population. Physicians, PAs, and NPs consume TV in concentrated dayparts, on-demand, and favor subscription streaming services along with broadcast networks.

Sources: M3 MI’s 2025 Doctors As Consumers Study; M3 MI’s 2025 PAs/NPs As Consumers Study; M3 MI’s 2025 MARS Consumer Health Study