Patients Increasingly Value Healthcare Television Ads

Amid Regulatory Headwinds This Trend Continues to Grow

Television has long been a cornerstone for many pharmaceutical marketers. Its ability to deliver disease education and branded treatment messaging to a large portion of a patient population is likely why pharmaceutical companies spent over $7.5 billion dollars in television in 2024, according to data from MediaRadar. This figure represents 13% of all national broadcast and cable advertising, positioning pharmaceutical brands among the top spenders in the linear television space. M3 MI’s recently released 2025 MARS Consumer Health Study reveals that a vast majority of patient groups continue to watch television:

- 93% of patients (defined as seeing a prescribing HCP in the past 12 months) watch television.

- That number climbs to 97% among people professionally diagnosed with a rare condition (defined as affecting less than 1% of the U.S. population).

However, the landscape for pharmaceutical advertising on television may be on the cusp of significant change. The proposed No Handouts for Drug Advertisements Act seeks to eliminate tax deductions for direct-to-consumer (DTC) advertising across most channels, including television. If passed, this legislation could impact media budgets across the industry.

Adding to the uncertainty, HHS Secretary Robert F. Kennedy Jr. has voiced support for an outright ban on pharmaceutical television ads. He argues that removing these ads could foster more cautious and informed prescribing practices, placing patient welfare above corporate interests.

So how do patients feel about healthcare television ads and their benefits?

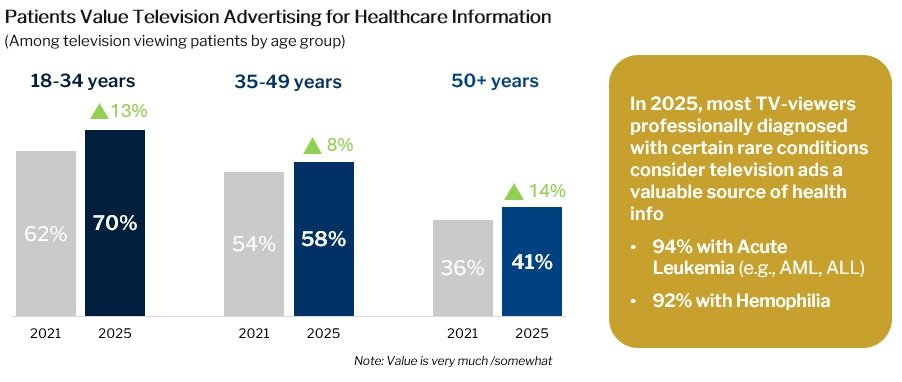

Television Ads Are Increasingly Valued

Patients across age groups who watch television are increasingly recognizing the value of pharmaceutical advertising as a source of healthcare information, with near double-digit percentage increases reported since 2021. The importance of television advertising is especially evident among those professionally diagnosed with certain rare conditions.

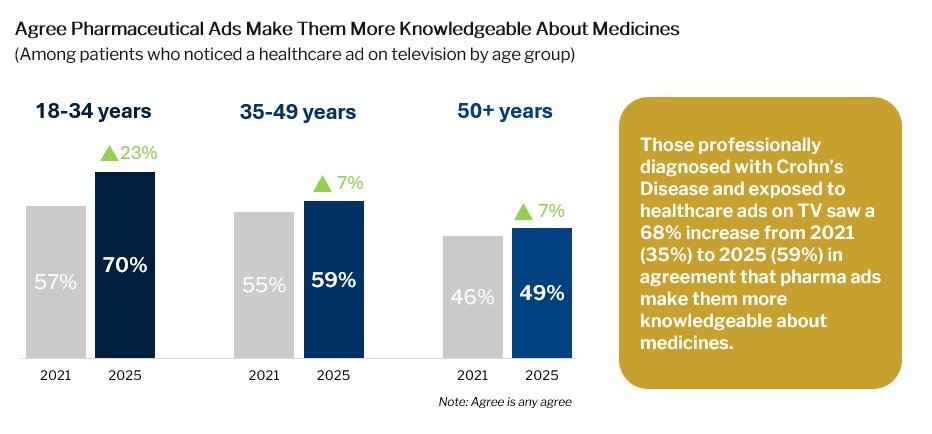

Growth In Benefit Regarding Pharmaceutical Ads

While Gen Z viewers of healthcare ads on television experienced a notable 23% increase in patients who felt pharmaceutical ads overall make them more informed about treatments, similar patients over 35 also continued to show steady growth in this perception.

Healthcare Ads Generate Action

3 in 5 patients who noticed a healthcare ad on television took action as a result of seeing any healthcare ads, with the top actions being related to treatment adherence (taking or refilling medication). When looking at a similar Gen Z audience, 79% took an action with their top one being watching a video online, illustrating the importance of video across channels.

Top 5 Actions Taken As a Result Of Healthcare Advertising

(Among patients who noticed a healthcare ad on television)

- Refilled a prescription

- Took medication

- Conducted an online search

- Made an appointment to see a doctor

- Purchased a non-prescription product

70% of professionally diagnosed Narcolepsy patients who noticed a healthcare ad on television took an action because of seeing any healthcare ads

In closing, as pharmaceutical marketers continue to invest in television, the channel remains a powerful tool for reaching and educating patients – especially those managing rare conditions and younger patients. With a majority of patients tuning in, and a growing number reporting that these ads help them feel more informed about treatment options, the value of healthcare advertising on television is clear. Pharmaceutical marketers should continue to monitor current legislation and be prepared to navigate potential changes to healthcare advertising guidelines/laws.

Daniel Lynch, Senior Manager – Insights and Analysis, M3 MI; a leading provider of healthcare consumer and physician media insights and marketing intelligence.

Note: Patients defined as saw a prescribing HCP in the last 12 months

Source: M3 MI’s 2021 – 2025 MARS Consumer Health Studies